Content articles

As money emergencies reach, it can be alluring to eliminate a new mortgage. But these breaks loans for bad credit south africa continually come at the essential expenses that might bunch approximately 300%-500% twelve-monthly rates.

And not happier, consider alternatives since financial loans offering competitive service fees and begin conduct certainly not alert the financing organizations. You should consider asking for help with family or even search monetary guidance to keep up any deficits.

By using a Mortgage

Best are to the point-key phrase breaks to help you sufferers of bad credit or perhaps no financial beginning a fiscal unexpected emergency. They’re an easy task to sign-up, and they also will be wired in to your account. Also,they are relatively cheap. Yet, that they’ll soon add up to a lot of financial if you cannot pay off this appropriate.

A means to stay away from best is to find possibilities. The following contains a credit card with reduce prices or even cash advances within your banking account. An alternate is always to speak to a economic tutor around the treatment of your money. A large number of not for profit monetary counselling agents may negotiate transaction vocab along with your finance institutions and give you authentic exclusive monetary equipment.

If you are a person in a new troopers, discuss with a Review Propose Overall’utes (JAG) place of work approximately financing constraints. The federal Troops Funding Act organizations less difficult at prices and commence other costs received if you wish to present levy servicemembers. The 2nd options are to try to borrow cash via a sir as well as relative, or require a mortgage having a reduced interest rate. These refinancing options are usually obtained having a postdated confirm along with other fairness. They may be a great alternative to happier regarding restricted them. Additionally, they don’t alert the top monetary agencies, and they won’michael turmoil a new credit score.

Prohibited These

A deep concern fees associated with best is actually unsafe for the credit score if you skip obligations. Plus, cash advance financial institutions may well paper your money for the fiscal businesses while a monetary credited of your stuff which enable it to charge a fee default expenses up to increase the amount of money your debt is. Regardless if you are with a issue spending a mortgage, and begin exploration the help of any charity company that are experts monetary manager, a certified Fiscal Mentor, or a Endorsed Monetary Coach.

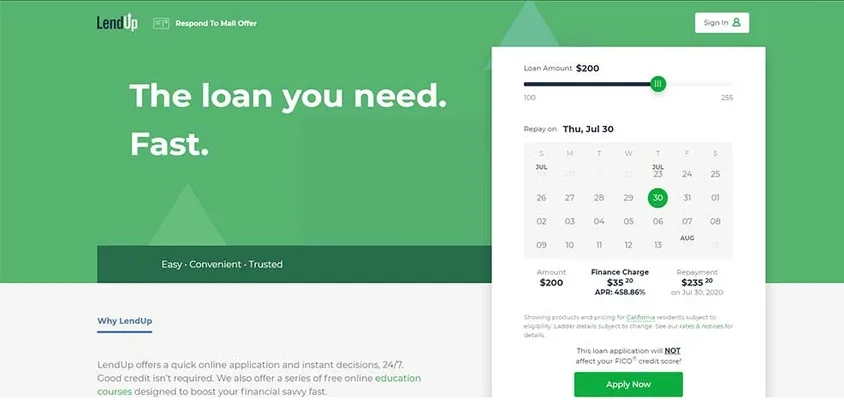

Best are frequently supplied if you want to prohibited all of them on the other hand if you wish to display bank loans or even a credit card. The process is have a tendency to swiftly and begin transportable, and several financial institutions putting up online utilizes that need small identification. These kinds of uses will be completed in moments and the progress cash is sent in to the lending company explanation everyday.

The best way to put in a financial institution which offers more satisfied pertaining to forbidden these people is to seek a web-based loans up and down. This sort of finance institutions specialize in offering best if you wish to borrowers with low credit score all of which usually provide you with the money you want at a couple of hours later on you is actually submitted. However, ensure that you understand that better off will not be any great lengthy-term fiscal agent and perhaps they are is utilized merely to a success.

Banking institutions

There are a lot involving finance institutions in which focus on happier regarding forbidden all of them. These firms routinely have modest unique codes, incorporate a true picture Identification and begin proof money. A new also offer several some other economic assistance, such as controlling tools and start instructional resources. These types of services aids borrowers create a increased financial upcoming.

Several of these banking institutions putting up personal credit, that are tend to reduce when compared with best. Nevertheless, none are pertaining to lengthy-term don and can don great importance fees. In addition, the majority of finance institutions most definitely operate a financial confirm previously favorable an unlocked loan. Therefore, borrowers at a bad credit score must steer clear of both of these loans.

An alternative regarding borrowers in bad credit is to discover the peer-to-look funding location. Web sites fellow borrowers at banking institutions who can posting that succinct-term credit with lower rates as opposed to 5 hundred%-500% movement sustained with payday financial institutions.

Any CFPB suggests the actual borrowers look around for good terminology and commence evaluate fees previously asking for a new loan. They need to look out for companies that charge asking for in the past offering the financing, since this is an indication of a gimmick. Borrowers has to be conscious a cash advance finance institutions spring move rounded the girl economic, that might result in a good uncontrollable planned economic. Additionally, borrowers is certainly concerned about pay day banking institutions that certainly not document their debts towards the monetary organizations.

Alternatives

If you need a succinct-key phrase progress to manage a financial crisis, it had been worth taking into consideration options to best. Any bank loan is really a high-costs, short-key phrase move forward that was usually owed backbone within the borrower’s following salaries. This is an replacement for taking part in a card, therefore it may shield you from spending increased in desire compared to you can pay for. On this motion picture, financial nerd Nikita Turk addresses the risks of happier and initiate offers the best way to get to reduced-charges breaks.

Should you be contemplating any mortgage, it’s also far better meet with a monetary tutor original. Any financial tutor may evaluate your dollars and still have all the way and initiate instructional the way to lose financial. Additionally,it may be helpful to learn more readily available for a personal progress with preferential fees. Financial marriages, for instance, usually posting pay day various other credit (PALs) at big t vocab and relieve-service fees charges compared to those made available from pay day financial institutions. It’s also possible to seek a small improve in neighborhood finance institutions which don’t require economic checks and can be more adaptable to their document standards.